Required Minimum Distributions: FAQ

Written by Carson Hamill CIM®, CRPC®, Associate Financial Advisor & Assistant Branch Manager, and Dean Moro BComm, CIM®, Associate Portfolio Manager

If you're approaching retirement age or have inherited a retirement account, understanding Required Minimum Distribution (RMD) rules and strategies is crucial for managing your retirement savings effectively. In this blog, we will demystify RMD rules and provide you with essential information to navigate this complex aspect of retirement planning.

- What is Required Minimum Distribution (RMD)?

- Which retirement plans require minimum distributions?

- What is the deadline to receive an RMD from an Individual Retirement Account (IRA)?

- RMD’s for beneficiaries

- How is an RMD calculated?

- Can the individual account owner take an RMD from one account instead of separately from each account?

- Can an account owner withdraw more than the RMD?

- Does your RMD have to be taken all at once?

- What is the penalty for not taking an RMD by the required date?

- Can the IRS waive the penalty for not taking the RMD?

- Can excess distributions in one year be applied to the RMD for a future year?

- How are RMDs taxed?

- Can RMD amounts be rolled over into another tax-deferred account?

- Donating your RMD to a charity

What is Required Minimum Distribution (RMD)?

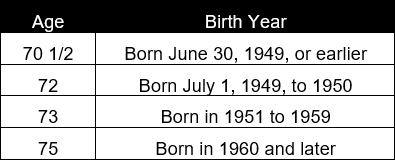

Required minimum distributions (RMDs) are the minimum amounts you are required to withdraw from your retirement accounts each year. You generally must start taking withdrawals from your retirement plan accounts (traditional IRA, SEP IRA, SIMPLE IRA) when you reach your required beginning date (RBD) age 72 (age 73 if you reach age 72 after December 31, 2022, age 75 if you reach age 74 after December 31, 2033).

Please note, if the retirement plan is an IRA account or the account owner is a five percent owner of the business sponsoring the retirement plan, the RMDs must start at RBD age regardless of whether the individual is retired or not.

The onus is on the retirement plan participant and IRA owner (this includes SIMPLE IRAs and SEP IRAs) to withdraw the required minimum before the calendar year end each year or they will encounter penalties.

Which retirement plans require minimum distributions?

Required minimum distribution rules apply to all employer sponsored retirement plans including:

- Traditional IRAs

- SEP IRA

- SIMPLE IRA

- 401(k) plans

- 403(b) plans

- 457

- Profit sharing plans

- Roth 401(k) – for 2024 and after, RMDs are no longer required from designated Roth 401(k) accounts.

Please note that Roth IRAs do not have RMD.

What is the deadline to receive an RMD from an Individual Retirement Account (IRA)?

The timing for receiving your RMD from your Individual Retirement Account (IRA) depends on several factors. Generally, you are required to start taking RMDs from your traditional IRA once you reach RBD age, as mandated by the Internal Revenue Service (IRS) regulations.

However, there are a few exceptions to this rule:

If you have a Roth IRA or Roth 401(k)

Roth IRAs are not subject to RMD rules during the original account holder's lifetime. However, if you inherit a Roth IRA, you may be subject to RMD rules. For 2023 and after, RMDs are no longer required from designated 401(k) accounts.

If you are still working

If you are still employed and participating in a qualified employer-sponsored retirement plan, such as a 401(k), and you are not a five percent or more owner of the company, you may be able to delay your RMDs from that specific employer's plan until you retire.

For those who need to take RMDs, the distribution must be completed by December 31st of each calendar year. However, please note that the initial RMD can be postponed until April 1st of the year following the year you turn RBD age, but subsequent RMDs must be taken by December 31st of each subsequent year.

Failing to take the full amount of your RMD or missing the deadline for distributions can result in significant tax penalties. Therefore, it's crucial to consult with a financial advisor or tax professional who can provide personalized guidance based on your specific situation to ensure compliance with RMD requirements.

RMDs for beneficiaries

RMDs for beneficiaries refer to the distributions that must be taken from inherited retirement accounts, such as traditional IRAs or employer-sponsored retirement plans, by the beneficiaries who inherit those accounts. The rules for RMDs vary depending on date of death and the relationship between the original account owner and the beneficiary.

Below is a general overview of how RMDs work for beneficiaries, but please note that tax laws and regulations can change, so it's always a good idea to consult with a financial advisor or tax professional for the most up-to-date information.

If the spouse is the primary beneficiary

If a spouse is the sole primary beneficiary of a retirement account, they have several options. They can treat the account as their own by rolling it over into their own IRA or employer-sponsored plan, and RMDs would not be required until they reach RBD age or retire, whichever is later.

Alternatively, a spouse beneficiary can choose to leave the retirement account as an inherited IRA, in which case they can begin taking RMDs based on their own life expectancy starting in the year the original account owner would have reached RBD age (or the year following the original account owner's death if they were already past RBD age).

Non-spouse beneficiaries

Non-spouse beneficiaries, such as children, grandchildren, or other individuals, have different options for RMDs. If the original account owner passed away before RBD (which is generally April 1st of the year following the year they turn 72), non-spouse beneficiaries can take distributions over their own life expectancy, if the original owner died prior to 2020. They would need to start taking RMDs by December 31st of the year following the original account owner's death.

If the original account owner died on or after their RBD, non-spouse beneficiaries typically have two options:

1) Take distributions over the remaining life expectancy of the deceased account owner based on the IRS Single Life Expectancy Table.

2) Use the "five-year rule" and withdraw all funds from the inherited account by the end of the fifth year following the original account owner's death.

The 10-year Rule

There is a 10-year rule that applies to certain beneficiaries of inherited retirement accounts. The 10-year rule was introduced as part of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, which became effective on January 1, 2020. The rule applies to beneficiaries who inherit retirement accounts from account owners who passed away on or after January 1st, 2020.

Based on this new rule, non-spouse beneficiaries, such as children, grandchildren, siblings, or other individuals, who inherit retirement accounts are generally required to withdraw the entire balance of the inherited account by the end of the 10th calendar year following the year of the original account owner's death. There may be annual RMDs required during this 10-year period, but the account must be fully distributed by the deadline.

There are a few exceptions to the 10-year rule. The following individuals are not subject to the 10-year distribution requirement and can still use the life expectancy method for RMDs:

1) Spouse Beneficiaries: A surviving spouse can still treat the inherited retirement account as their own and follow the rules that applied to their own retirement accounts. They have the option to delay RMDs until they reach RBD age (or retire, whichever is later) or can choose to begin taking RMDs immediately based on their own life expectancy.

2) Eligible Designated Beneficiaries: Eligible designated beneficiaries include minor children of the original account owner (until they reach the age of majority), disabled individuals, chronically ill individuals, and beneficiaries who are less than ten years younger than the deceased account owner. These individuals are generally allowed to use the life expectancy method and take RMDs over their own life expectancy.

It's important to note that the ten-year rule requires the entire balance of the inherited account to be distributed by the end of the 10th year. The rule applies to both traditional IRAs and employer-sponsored retirement plans, with a few exceptions for certain types of beneficiaries, as mentioned above.

As always, it's advisable to consult with a financial advisor or tax professional to understand how the 10-year rule specifically applies to your situation, considering any recent updates to the tax laws and regulations.

How is an RMD calculated?

The RMD is calculated for an account by dividing the prior year’s December 31st balance of the retirement plan account by a life expectancy factor that the IRS publishes.

The equation is as follows:

RMD = Prior year’s December 31st balance of the plan / life expectancy factor

Click Here to view the IRS RMD worksheets

Can the individual account owner take an RMD from one account instead of separately from each account?

An individual IRA owner needs to calculate the RMD separately for each IRA account that they own. With that being said, you are allowed to withdraw the cumulative total amount of your RMDs for the year from one account or more.

The same goes for a 403(b)-plan account - the individual needs to calculate the RMD separately for each 403(b) account they own, although they can take the total RMD amount from one account or more.

Please note that RMDs for 401(k) and 457(b) accounts must be taken separately from each individual plan account.

Can an account owner withdraw more than the RMD?

Yes, you can withdraw more than your required minimum distribution amount. Please note that your withdrawals will be included in your taxable income.

Does your RMD have to be taken all at once?

No. You can withdraw your annual RMD in any number of disbursements during the year, as long as you satisfy the annual minimum amount by December 31st, or April 1st of the following year if it is your first RMD.

What is the penalty for not taking an RMD by the required date?

In the event that the account holder does not withdraw the RMD within the designated yearly period, a penalty may be imposed. The Internal Revenue Service (IRS) will levy a 25% penalty, referred to as the excise tax, for each dollar that remains unwithdrawn. Nevertheless, if the failure is promptly rectified, the penalty can be reduced from 25% to 10%.

Can the IRS waive the penalty for not taking the RMD?

Yes, if the deadline was missed due to a reasonable cause an IRA owner may request to have the IRS waive the penalty.

It is always best to review the situation with your cross-border accountant if you missed taking an RMD.

Can excess distributions in one year be applied to the RMD for a future year?

No, distributions over and above the required minimum cannot be applied to a future year.

How are RMDs taxed?

The RMD withdrawal is taxed at the individual’s marginal income tax rate. The RMD is not considered earned income, however.

Can RMD amounts be rolled over into another tax-deferred account?

RMD amounts can not be rolled into another tax-deferred account. However, the funds can be deposited into a taxable brokerage account.

Please speak to your cross-border financial advisor for more clarity.

Donating your RMD to a charity

You can donate money directly from your IRA to qualified charities, and this donation will not be taxed. The amount you donate also counts towards your required minimum distribution (RMD) for the year. If you are 70 1/2 or older, you can donate up to $50,000 of the $100,000 in a single tax year to a charitable gift annuity.

Please speak to your cross-border accountant for more information.

In summary

Working with an experienced cross-border advisory team can provide you with peace of mind, ensure compliance with tax regulations, and help you make well-informed decisions regarding your RMDs and retirement savings accounts. Your cross-border financial advisor will assess your retirement savings accounts, analyze your RMD requirements, and provide guidance on investment strategies, asset allocation, and other financial considerations to help you maximize your retirement income.

Contact Snowbirds Wealth Management to learn more.

Next steps

If you’re planning on moving to Canada and need assistance with your investments, estate planning, and portfolio management, please call or email us at Snowbirds Wealth Management as we specialize in cross-border financial planning and wealth management. We work closely with experienced cross-border lawyers and accountants to ensure you have a team behind you.

About Snowbirds Wealth Management

Gerry Scott is a portfolio manager and founder of Snowbirds Wealth Management, an advisory firm focused on the cross-border market. Together with Dean Moro and Carson Hamill, associate financial advisors with Snowbirds Wealth Management, they provide investment solutions for Americans living in Canada, and Canadians residing in the United States. Licensed in both Canada and the US, they provide tailored investment solutions to minimize the tax burden when moving assets across borders.

To schedule an introductory call, please click here.

Statistics and factual data and other information are from sources RJLU believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities nor is it meant to replace legal, accounting, taxation or other professional advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The information is furnished on the basis and understanding that RJLU is to be under no liability whatsoever in respect thereof.

Raymond James (USA) Ltd. advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Investors outside the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Raymond James (USA) Ltd. is a member of FINRA/SIPC.